Designing the Chase Credit and Debit card

The original, numberless, debit card, unveiled in 2021 with the launch of Chase in the UK.

The original, numberless, debit card, unveiled in 2021 with the launch of Chase in the UK.

The vision

Card experiences that stand out

Flagship designs that differentiate us from competitors and build a deeper emotional connection with our cardholders.

Debit and credit cards are regular, high-frequency touchpoints with both product and brand

They play a key role in shaping brand perception, driving customer acquisition and retention, and boosting transaction volume through emotional and functional appeal.

Definining the positioning

How

Understand the product proposition, customer needs, and competitive landscape — and align with Chase’s brand strategy.

Flexible yet consistent

Create designs that are distinctive and clearly tiered (e.g. debit vs credit, personal vs business, everyday vs exclusive) while maintaining a coherent visual system recognisable as Chase.

Digital and physical

Designs should work across digital wallets, app UI, and physical cards — meeting accessibility, production, and vendor specifications across all touchpoints.

Card furniture

When designing across a suite of cards — from everyday to premium — I established a consistent layout for what I refer to as card furniture: the fixed elements that form the structural backbone of any card.

These include the chip, the Chase logo, the customer’s name, the product descriptor, and the Mastercard programme identifier. Regardless of the card’s aesthetic or material finish, these components are essential and ever-present. By anchoring them in the same position across all tiers,

I aimed to create a sense of continuity and familiarity, making the cards instantly recognisable as part of a unified family, while still allowing visual expression and material variation to differentiate the offer.

Card Furniture across multiple assets

A view of card furniture placement across the entire card estate, illustrating how each fixed element is positioned consistently.

Debit card proposal

When designing across a suite of cards — from everyday to premium — I established a consistent layout for what I refer to as card furniture: the fixed elements that form the structural backbone of any card.

These include the chip, the Chase logo, the customer’s name, the product descriptor, and the Mastercard programme identifier. Regardless of the card’s aesthetic or material finish, these components are essential and ever-present. By anchoring them in the same position across all tiers,

I aimed to create a sense of continuity and familiarity, making the cards instantly recognisable as part of a unified family, while still allowing visual expression and material variation to differentiate the offer.

Card Furniture across multiple assets

A view of card furniture placement across the entire card estate, illustrating how each fixed element is positioned consistently.

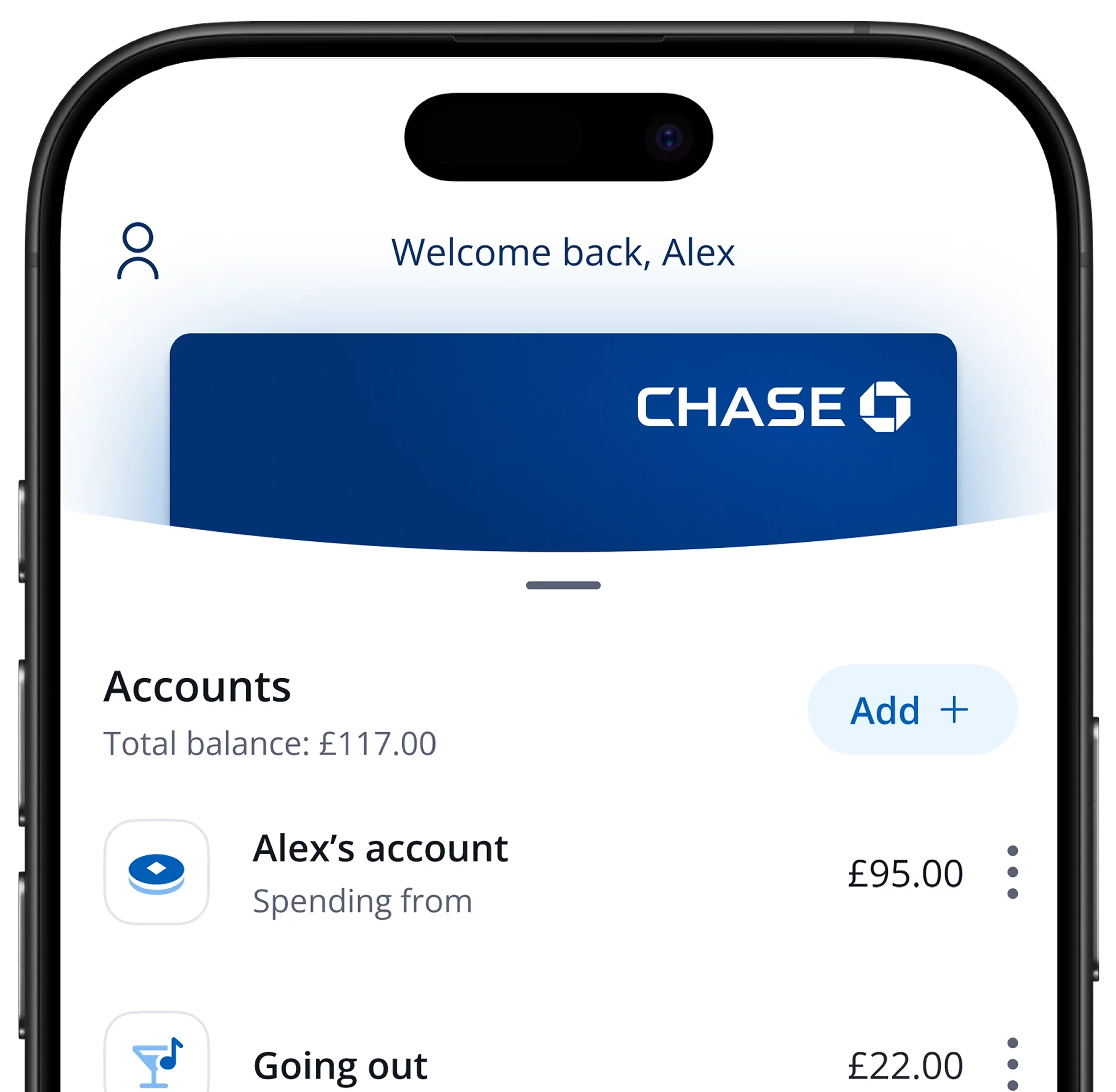

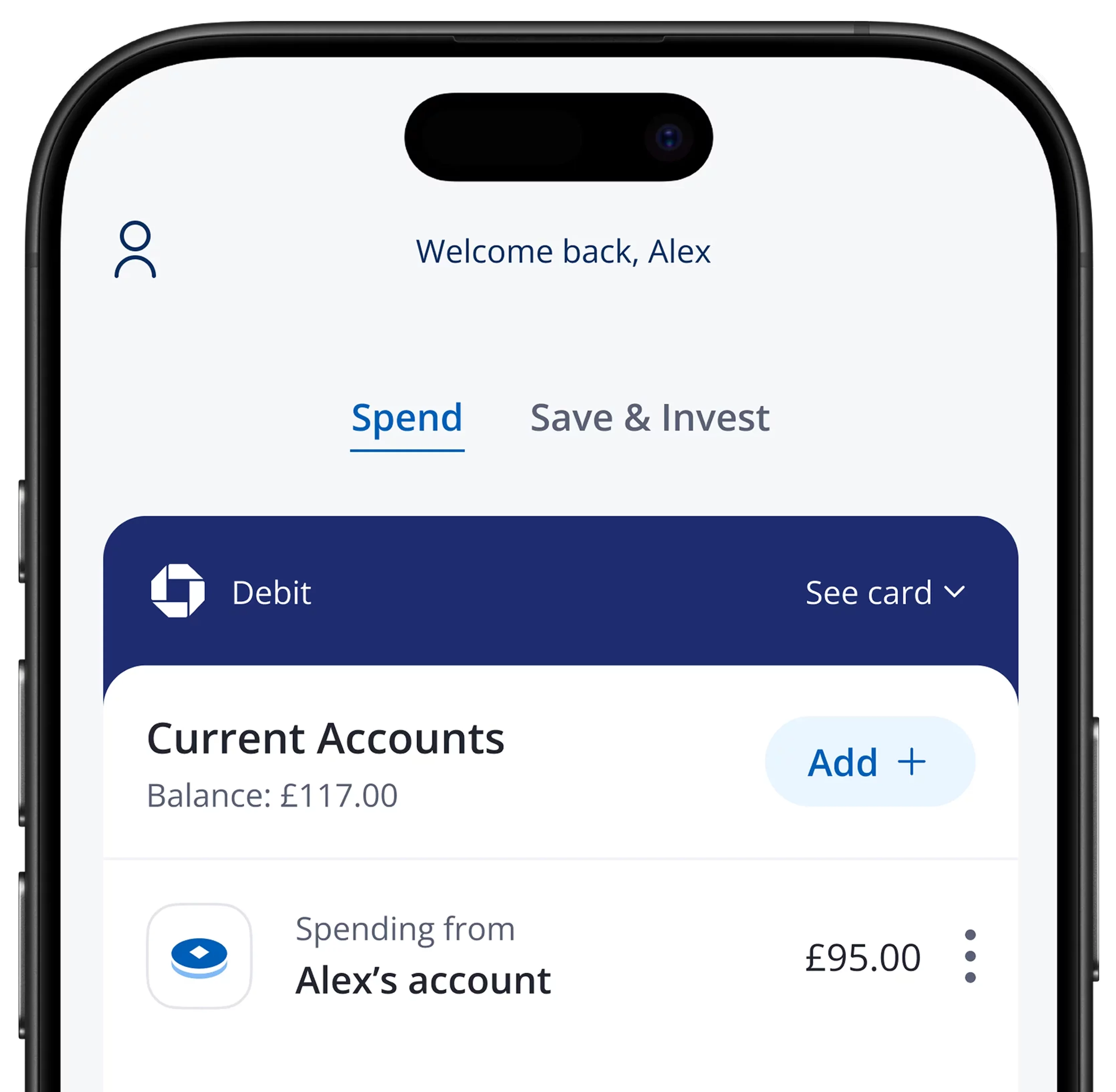

We launched the new debit card together with improvements to the ‘Home’ screen. Customers now recognise the card as interactive, not just a static image, and clearer labels like ‘Debit’ and ‘See card’ make it easier to find their card number.

I also wanted the card visual to remain as a slider, alongside the account listing, providing a seamless way to move into the card hub.

This design choice also gave us room to support additional cards on a customer’s account, if needed in future.

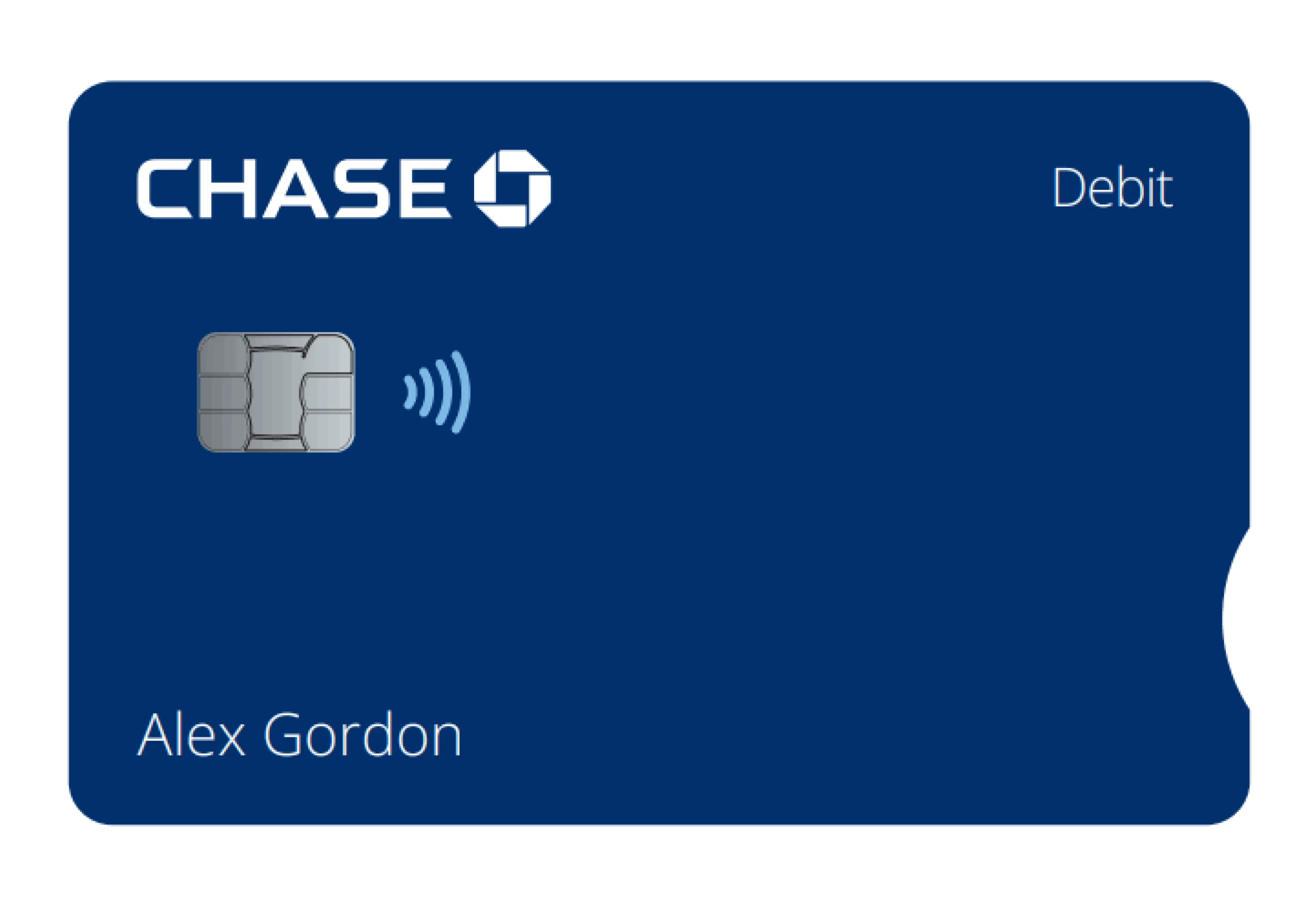

Changes on the front of the card:

- The contactless identifier was moved to the front to make it clearer to customers that the card was contactless.

- To accommodate a product identifier, the Chase logo was repositioned to the top left, leaving the top right available to label the card type. While this example shows ‘Debit’, the same space could be used for future offerings like Joint or Premium cards.

- The customer’s name is now set in lowercase for improved readability and printed using hardened UV ink rather than laser etching. This results in a brighter, clearer finish, avoiding the ‘burnt edge’ effect seen in earlier versions. The name is also slightly larger to support better legibility, particularly for customers with vision impairments.

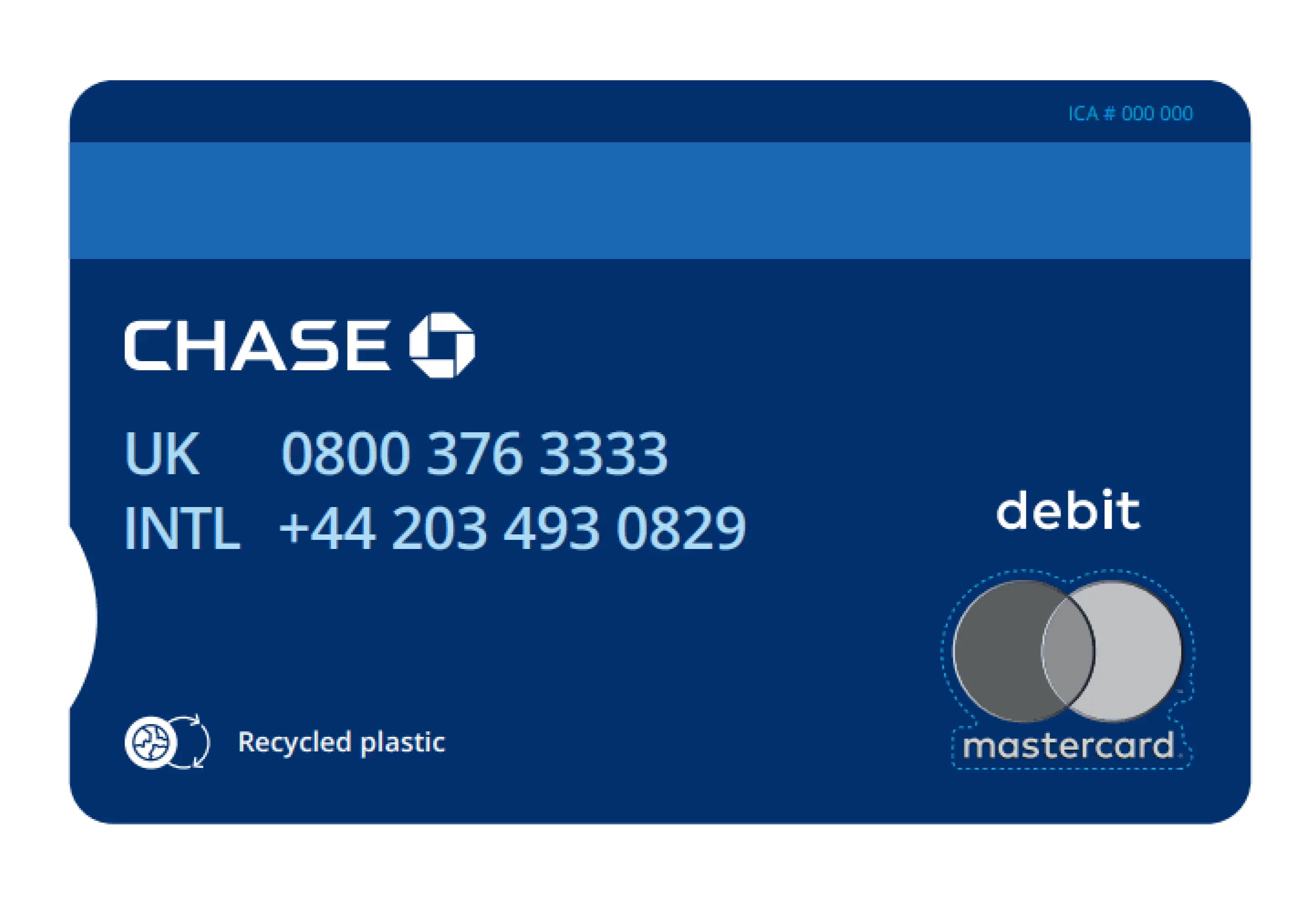

Changes on the rear of the card:

- The contact centre numbers were enlarged to improve legibility, particularly for customers with vision impairments. The colour was also adjusted to meet minimum contrast requirements for accessibility.

- The Mastercard programme identifier remained in the bottom right, with the ‘Debit’ mark positioned directly above it.

Increasing accessibility on our cards

As part of our commitment to inclusive design, I incorporated Mastercard’s Touch Card system into the Chase card suite. These tactile notches, placed along the edge of the card, allow blind and partially sighted customers to distinguish between Debit, Credit, and Prepaid cards by touch alone — each with a unique cut. It’s a simple design intervention, but one that has a profound impact on autonomy and dignity for those who need it.

According to the Royal National Institute of Blind People (RNIB), over 2 million people in the UK live with sight loss, and around 340,000 of them are registered as blind or partially sighted. For these customers, even a basic task like paying for something with the right card can introduce unnecessary friction or dependence on others. By adding a tactile identifier, we removed that barrier and allowed customers to interact with their cards confidently, without needing to rely on others or take their phone out to double-check.

This wasn’t just about meeting accessibility guidelines — it was about building a product experience that worked for everyone, including those too often overlooked. The Touch Card system brought a clear benefit to a specific group of users, but also reflected well on the brand. It demonstrated that Chase considers the details that matter and is willing to adopt thoughtful, systemic changes that improve usability at every level.

For us, it was never a box-ticking exercise. It was about making design decisions that reflect our values — creating tools that are intuitive, empowering, and inclusive by default.

Applying the card framework to the Credit card

Once the framework was established and the Debit card launched, it provided a foundation for producing future cards in a consistent way.

This approach meant new cards could be developed to match the services they represented. We were careful not to release a premium-feeling card unless the product experience warranted it — the card needed to reflect the actual value customers received. At the same time, every card had to maintain the trusted, recognisable feel of the Chase brand.

Product highlights

This is the first credit product offered by Chase in the UK market in 2025, introduced following the success of its current account and debit card.

The card features:

- 0% interest on purchases for up to 15 months, helping customers spread the cost of spending without fees.

- No annual fee, aligning with Chase UK’s transparent pricing model.

- No foreign transaction fees, making the card travel-friendly and competitive against leading FX-free cards.

- Numberless card design, with card details managed securely in the app to reduce fraud risk and visual clutter.